Financial Independence: Summary

Financial Independence: Summary

We learned about the different milestones during our journey towards financial independence. In this article, we'll summarize what we learned.

Financial Independence Stages

Here're the financial independence zones:

- Red zone — Our income barely or does not meet our expenses.

- Blue zone — Our income meets our expenses, but we have to keep working. The good news is that we're slowly able to first create an emergency reserve, then start putting some of our income into investments that grow over time.

- Green zone — We reach a point where the gains from our investments alone are sufficient to meet our expenses without impacting the investments' growth.

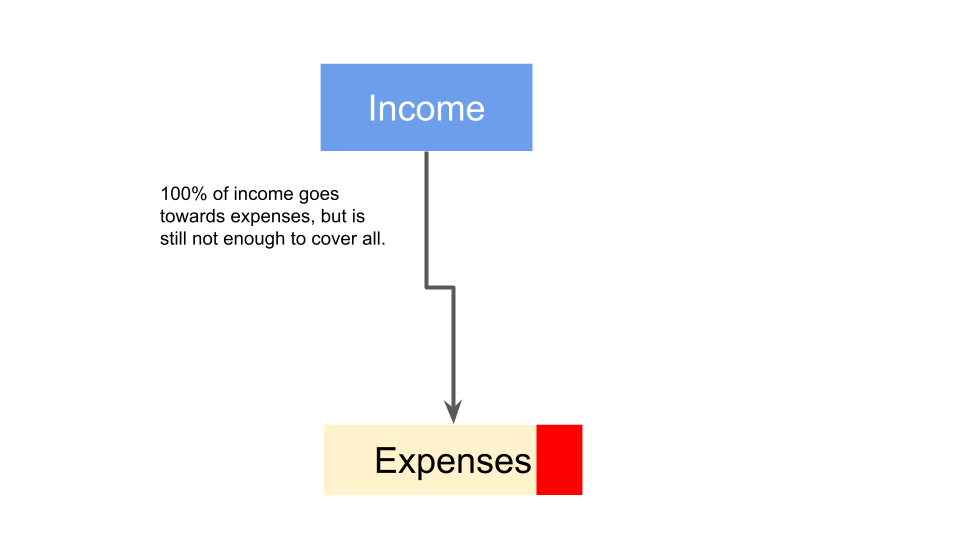

Red Zone

Our situation in the red zone looks like this. Our expenses are more than what we earn, putting us in the red.

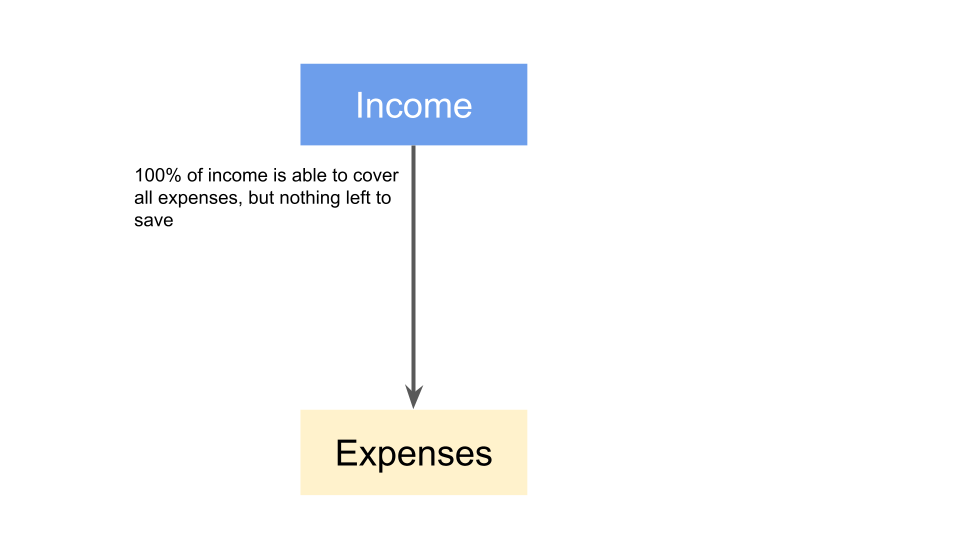

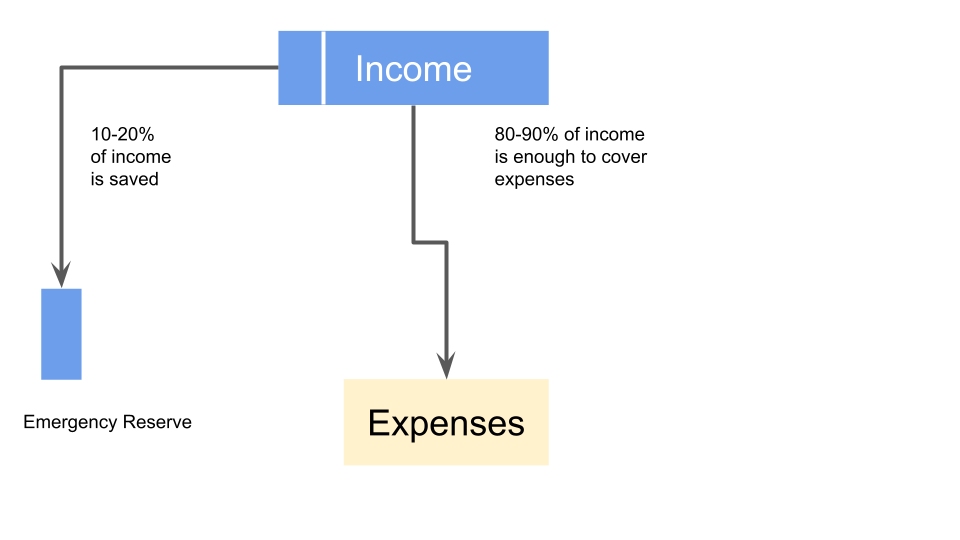

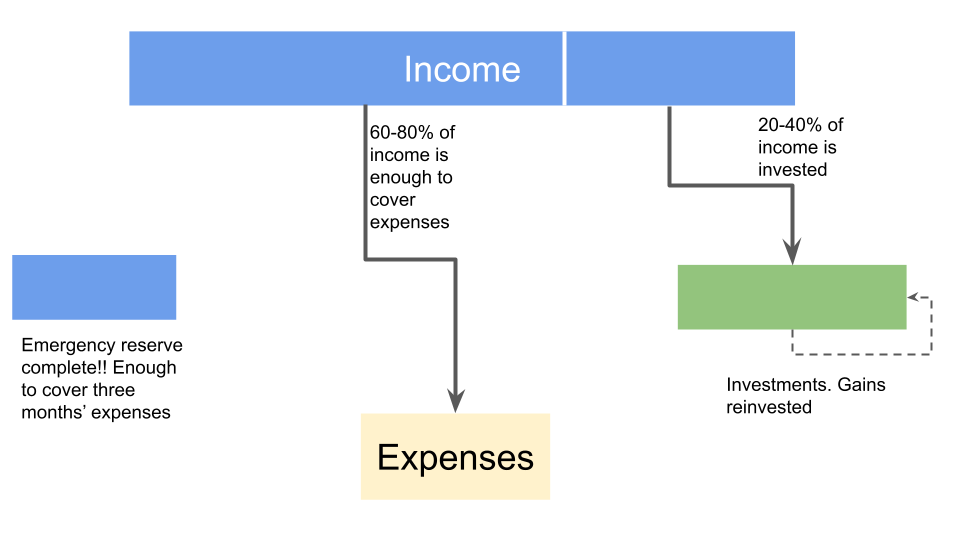

Blue Zone

As we climb out of the red zone, by a combination of trimming our expenses and increasing our income, we first reach a stage where our income is (just) able to meet our expenses. This is a very good start:

When we are able to save a bit, our first priority is to create an emergency reserve that, when fully funded, can sustain us for at least three months:

Next, once our emergency reserve is complete, we start creating growth investments and putting some of our income into them. As we are also focusing on strategies to increase our income, we're able to invest more. Here's what our status looks like. We'll probably be in this stage for some years:

Green Zone

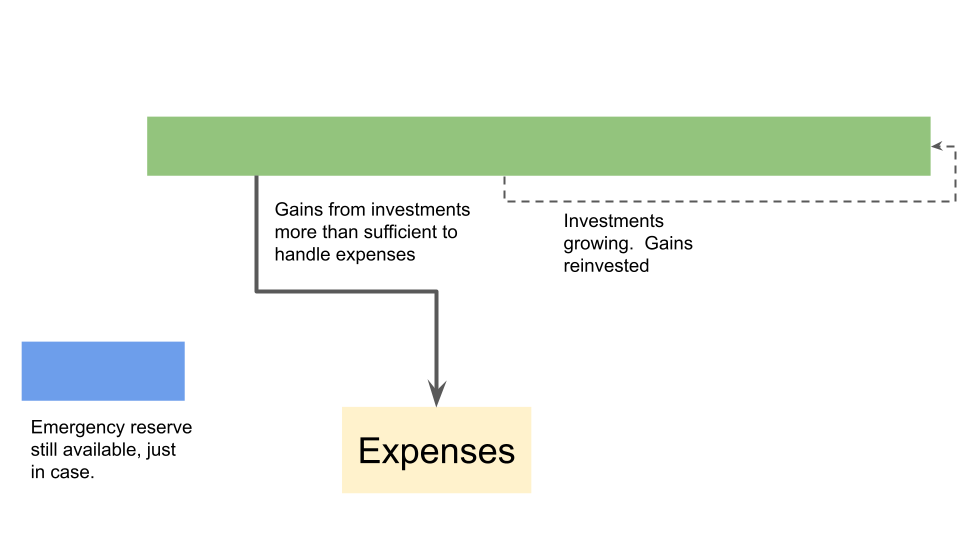

Once we reach the point where we're now able to fund our expenses entirely using our investment gains (our "passive" or "secondary" income), we're in the green zone. The income from our "day job" is no longer needed, as long as we take care to protect our investments which are our main sources of funding. However, depending on other factors (passion for our line of work, membership in our professional community, desire to keep busy, etc.), we could continue to have a "day job":

Summary

Our goal is to move towards the green zone. We're disciplined and committed to make this happen. We fully understand that this probably won't happen overnight and is a multi-year (or even a multi-decade) process.

Our growth is fueled by two strategies: 1) reduce expenses where possible; 2) work towards increasing the income that our "day job" provides as well as the gains from our investments. The combination of these strategies accelerate our journey towards the green zone. The previous articles in this series provide us with suggestions and options.