Stocks

Thanks to the wealth of information and tools on the Internet, investing in stocks is becoming easier. As a result, more and more individual investors are taking a stab at managing their stock portfolio themselves.

Continue...

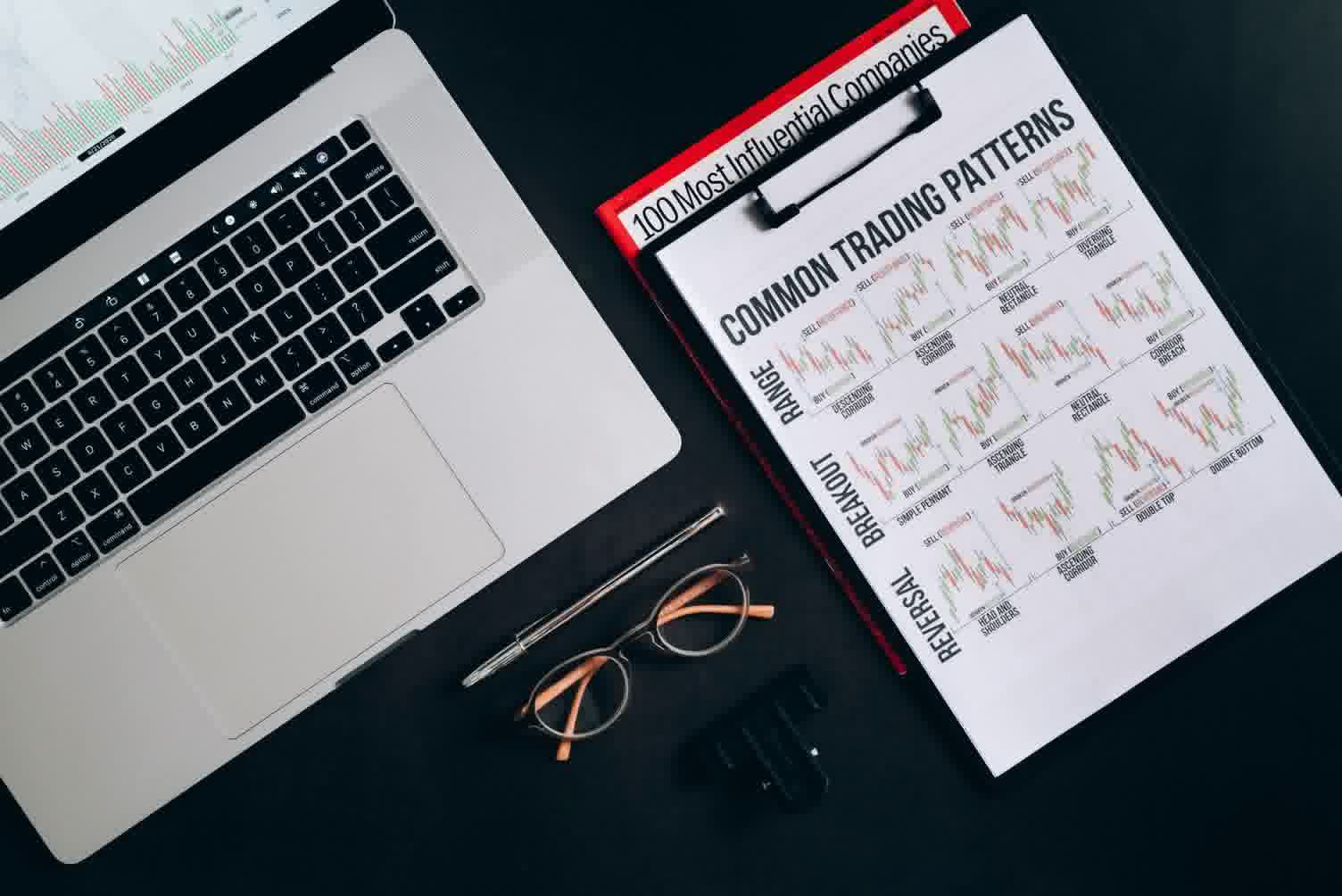

In the previous article we went over the principles of investing in stocks, and briefly touched upon an 'investment profile'. An investment profile is a place where we define our investment parameters — parameters that guide us in analyzing, buying, and selling stocks.

Continue...

In the previous article we created our investment profile and seeded it with some parameters. In this article we'll understand how the parameters in the profile are used when buying stocks.

Continue...

In the previous article we looked at stock analysis, and using that, perhaps shortlisted some stocks as good candidates to invest in. In part 2 of the "what to buy" step, we'll look into a simulation technique to explore different investment strategies and their effect on stock performance historically.

Continue...

In the previous article we learned about different parameters we can use to simulate stock trading using historic stock prices. In this article, we'll look at the results of a sample simulation and understand how to use this to decide which investment strategy works best.

Continue...

In the previous two articles (here and here), we explored the topic of "which stocks to buy." This helped us create a list of stocks worth investing in. In this article, we'll look at the question "when to buy a stock?"

Continue...

In previous articles (see sidebar), we learnt how to analyze stocks and to simulate trading, to help narrow down the stocks that we want to invest in. We also learnt to wait until the stock price is on the rise. Now it is time to go to the next step — the actual buying. In this article, we'll learn to decide how many shares to buy.

Continue...

In the previous article we discussed buying stocks. Now it is time to start monitoring the stock price for the stocks we just invested in. This is known as position-watching or monitoring the position.

Continue...

In the previous article we discussed stock price life cycle events and alerts. In this article we'll look at events and alerts that help answer the question "when to sell a stock?"

Continue...

Cost basis is the effective purchase price of a stock to use for tax purposes. In this article we'll understand how it works, its implication on both our gains and taxes, and look at a few ways the cost basis can be determined.

Continue...

It is always a good idea to regularly review our stock investment strategies (including our profile parameters) with our financial advisor, to understand how effective they have been.

Continue...

In the article Investing in Stocks - 6: Buying Stocks we discussed stock 'position sizing'. The companion calculator here uses the position sizing technique to compute the number of shares to buy so that we limit our losses.

Continue...

This illustrator helps learn about the effect of different cost basis methods on stock sale gains. See Investing in Stock - 9: Stock Cost Basis Methods to understand cost basis.

Continue...