Topic: Saving

Emergency reserves serve a single purpose: if all other sources of income and investments fail, we can still survive for a few months and use that time to get back on our feet. In this article we'll explore ways to create emergency reserves.

Continue...

Targeted saving is a simple technique to save for a specific goal or target. This is very useful when we want to separate a portion of our savings or investments so that it grows independently and doesn't get used for general day to day expenses.

Continue...

Automating our savings process allows us to set things up so that the saving happens automatically (e.g., as soon as our pay arrives, on a specific date every month, etc.).

Continue...

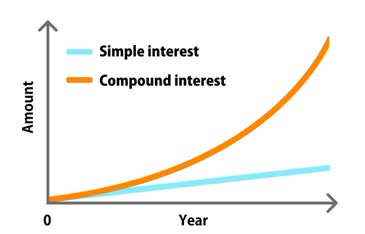

In this article, we'll explore and understand how compound interest works and how it can help our investments grow faster and really make a big difference. It is a great technique to use when saving or investing for the longer term.

Continue...

When interest rates decrease, it is an opportunity to refinance our existing home loan to either reduce our monthly mortgage payment or pay off our loan sooner. We'll explore a few ways to achieve this.

Continue...

Retirement funds allow us to withdraw from them periodically (monthly or annually). Typically, such funds tend to also have a withdrawal window of about forty years or so. In other words, we would be allowed to withdraw from these starting, say, in our sixties and continue withdrawing till our death.

Continue...

Here is a simple calculator to play with our expense/saving/investment ratios to get a feel for how (and how much) to allocate our money towards investments.

Continue...

In the article Creating Targeted Savings we saw the benefits of saving towards specific targets. The corresponding calculator is here.

Continue...