Articles

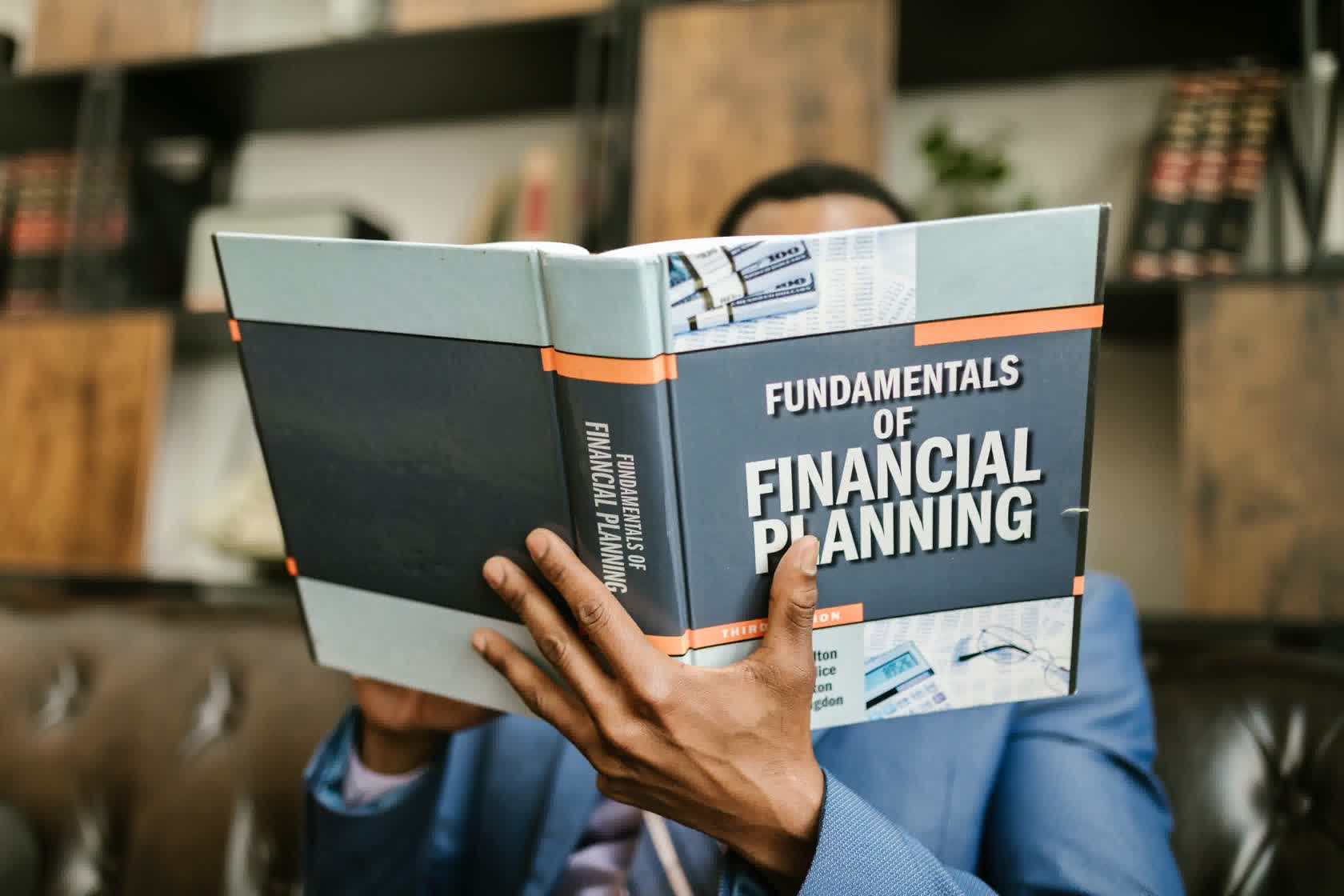

If you are looking to understand personal finance and to get a bird's eye view of the concepts and topics before diving deeper, you've come to the right place! In this article, we'll look various aspects of personal finance, learn concepts, and proceed to articles that provide details.

Continue...

This is the first of a series of articles that provide step by step instructions on progressing towards financial independence. We'll use a unique and accurate way to quantify our financial health status, and based on that come up with concrete steps to improve and enhance it.

Continue...

In Step 1 we looked at the different zones of financial health status and how to accurately evaluate which zone we are in, financially. In this article, we'll look at ways to progress out of the red zone towards true financial independence.

Continue...

In Step 2 we looked at ways to kick-start the journey to get out of the red zone. We saw that reducing our expenses and increasing our savings are good starting points. Let's continue the steps that help us the most in getting to the blue zone.

Continue...

In Step 3 we looked at a few ways to get to the blue zone. If we've been following and implementing the steps mentioned so far, it's time to congratulate ourselves — we're officially in the blue zone! In this article we continue on from there to explore ways to achieve more financial independence on our path towards the green zone.

Continue...

In Step 4 we learnt about the different kinds of investments, their characteristics, and how these could help us create secondary income sources. In this step, we'll learn how to apply what we learnt and create investments to propel us towards the green zone.

Continue...

We learned about the different milestones during our journey towards financial independence. In this article, we'll summarize what we learned.

Continue...

Sometimes we feel that money is simply passing through our hands, at a faster pace than we can keep track of! At such times, budgeting is a time-tested way of telling us where our money is going.

Continue...

Emergency reserves serve a single purpose: if all other sources of income and investments fail, we can still survive for a few months and use that time to get back on our feet. In this article we'll explore ways to create emergency reserves.

Continue...

Targeted saving is a simple technique to save for a specific goal or target. This is very useful when we want to separate a portion of our savings or investments so that it grows independently and doesn't get used for general day to day expenses.

Continue...

Automating our savings process allows us to set things up so that the saving happens automatically (e.g., as soon as our pay arrives, on a specific date every month, etc.).

Continue...

Lifestyle creep is when our expenses start increasing faster than what our income can keep up with. As the term suggests, it creeps up on us, until the effects hit us one day — we are living paycheck to paycheck and/or having to borrow to survive financially.

Continue...

Smart spending is about mindful spending — identifying techniques to make our money go further. Just as it is important to decide what to spend money on, it is equally important to spend wisely.

Continue...

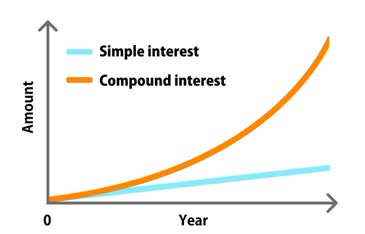

In this article, we'll explore and understand how compound interest works and how it can help our investments grow faster and really make a big difference. It is a great technique to use when saving or investing for the longer term.

Continue...

Understanding different types of investments and their pluses and minuses provides us with the knowledge and confidence to invest our money. Such knowledge helps us select the best investments for our needs.

Continue...

Age offers advantages and disadvantages when it comes to selecting investments. In this article we'll explore ways to optimize our investments to take full advantage of our age.

Continue...

Investing our money across different investment types is called asset allocation. The ratio of money invested in different investment types is termed allocation ratio.

Continue...

Understanding Investment Types lists the different types of investments, mutual funds being one of them. This article goes a little bit deeper into mutual funds.

Continue...

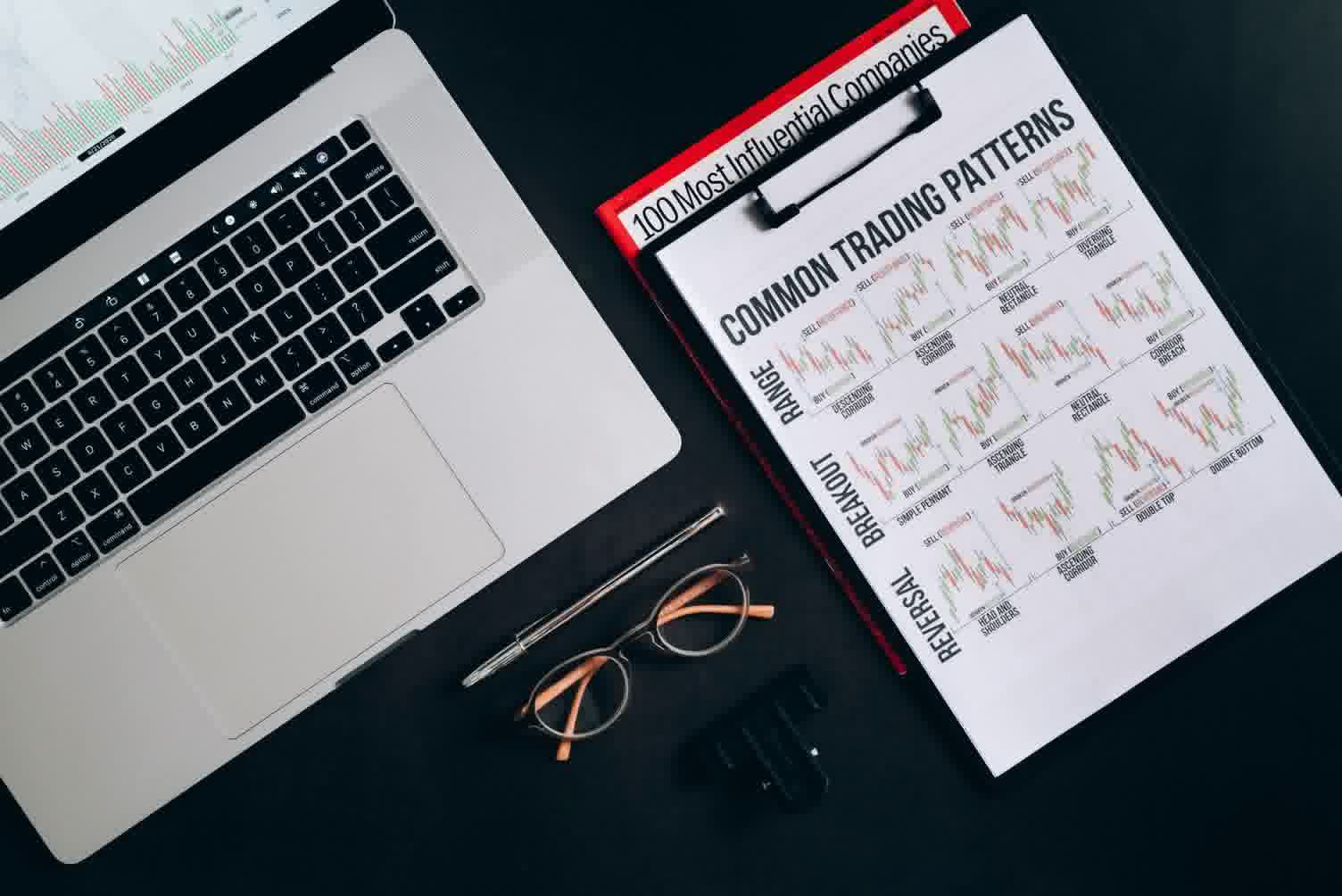

Thanks to the wealth of information and tools on the Internet, investing in stocks is becoming easier. As a result, more and more individual investors are taking a stab at managing their stock portfolio themselves.

Continue...

In the previous article we went over the principles of investing in stocks, and briefly touched upon an 'investment profile'. An investment profile is a place where we define our investment parameters — parameters that guide us in analyzing, buying, and selling stocks.

Continue...

In the previous article we created our investment profile and seeded it with some parameters. In this article we'll understand how the parameters in the profile are used when buying stocks.

Continue...

In the previous article we looked at stock analysis, and using that, perhaps shortlisted some stocks as good candidates to invest in. In part 2 of the "what to buy" step, we'll look into a simulation technique to explore different investment strategies and their effect on stock performance historically.

Continue...

In the previous article we learned about different parameters we can use to simulate stock trading using historic stock prices. In this article, we'll look at the results of a sample simulation and understand how to use this to decide which investment strategy works best.

Continue...

In the previous two articles (here and here), we explored the topic of "which stocks to buy." This helped us create a list of stocks worth investing in. In this article, we'll look at the question "when to buy a stock?"

Continue...

In previous articles (see sidebar), we learnt how to analyze stocks and to simulate trading, to help narrow down the stocks that we want to invest in. We also learnt to wait until the stock price is on the rise. Now it is time to go to the next step — the actual buying. In this article, we'll learn to decide how many shares to buy.

Continue...

In the previous article we discussed buying stocks. Now it is time to start monitoring the stock price for the stocks we just invested in. This is known as position-watching or monitoring the position.

Continue...

In the previous article we discussed stock price life cycle events and alerts. In this article we'll look at events and alerts that help answer the question "when to sell a stock?"

Continue...

Cost basis is the effective purchase price of a stock to use for tax purposes. In this article we'll understand how it works, its implication on both our gains and taxes, and look at a few ways the cost basis can be determined.

Continue...

It is always a good idea to regularly review our stock investment strategies (including our profile parameters) with our financial advisor, to understand how effective they have been.

Continue...

Credit cards have become synonymous with convenience. They eliminate the need to carry cash around and to buy things online. Like anything financial, credit cards come with both rewards and risks. Understanding these helps us use them smartly.

Continue...

In this article we'll learn about loans and understand the differences between some common loan types.

Continue...

In this article, we'll learn about debt and credit, and look at strategies to use it efficiently.

Continue...

When interest rates decrease, it is an opportunity to refinance our existing home loan to either reduce our monthly mortgage payment or pay off our loan sooner. We'll explore a few ways to achieve this.

Continue...

Retirement funds allow us to withdraw from them periodically (monthly or annually). Typically, such funds tend to also have a withdrawal window of about forty years or so. In other words, we would be allowed to withdraw from these starting, say, in our sixties and continue withdrawing till our death.

Continue...

As we proceed on our journey towards financial independence, the thought of giving back to the community and helping others is on most people's minds. In addition to the warm feeling it provides, giving back signals to the world that we're all in it together. In this article, we'll explore some ways of "smart giving" — giving in such a way that the effects last for a longer time.

Continue...

When kids reach the age when they start understanding money a bit — that goods cost money, more money buys more goods, etc., it is a good time to start teaching them about being savvy with money.

Continue...