Topic: Investing

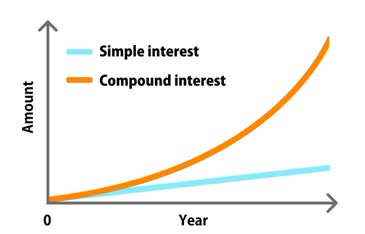

In this article, we'll explore and understand how compound interest works and how it can help our investments grow faster and really make a big difference. It is a great technique to use when saving or investing for the longer term.

Continue...

Understanding different types of investments and their pluses and minuses provides us with the knowledge and confidence to invest our money. Such knowledge helps us select the best investments for our needs.

Continue...

Age offers advantages and disadvantages when it comes to selecting investments. In this article we'll explore ways to optimize our investments to take full advantage of our age.

Continue...

Investing our money across different investment types is called asset allocation. The ratio of money invested in different investment types is termed allocation ratio.

Continue...

Understanding Investment Types lists the different types of investments, mutual funds being one of them. This article goes a little bit deeper into mutual funds.

Continue...

Thanks to the wealth of information and tools on the Internet, investing in stocks is becoming easier. As a result, more and more individual investors are taking a stab at managing their stock portfolio themselves.

Continue...

Retirement funds allow us to withdraw from them periodically (monthly or annually). Typically, such funds tend to also have a withdrawal window of about forty years or so. In other words, we would be allowed to withdraw from these starting, say, in our sixties and continue withdrawing till our death.

Continue...

Here is a simple calculator to play with our expense/saving/investment ratios to get a feel for how (and how much) to allocate our money towards investments.

Continue...

We discussed investing in various articles: Understanding Investment Types, The Power of Compounding, Age-appropriate Investing, etc. The investment calculator here helps in estimating how to allocate our funds.

Continue...