Age-appropriate Investing

Age-appropriate Investing

Age offers advantages and disadvantages when it comes to selecting investments. In this article we'll explore ways to optimize our investments to take full advantage of our age.

We might be thinking: "What does age have to do with investing? Don't both young and old get the same returns from an investment?" It is true that, once invested, the investment itself doesn't care about whether we are younger or older. But, as we'll see, age could have a positive or negative impact on our investments.

Investing When Younger

There are several aspects of investing that we can take advantage of when we are younger.

Aspects of a Younger Investor

- Pro: when younger, we have a potentially long investment window. If we start investing early and invest for longer periods, we get the full benefit of compound interest — interest that grows at a faster rate. As the article The Power of Compounding describes, compound interest takes off exponentially as time goes by.

- Con: we're probably not that experienced about investing and need to research and experiment.

- Pro: we have more time to recover from our investment "mistakes" and "experiments".

Strategies

- We can take full advantage of compounding. The key is to select investments that grow steadily (even if by only a small amount) instead of fluctuating up and down, so that every year we pick up extra interest (which then gets added to next year's starting amount). Later in this article, we'll see an example that illustrates this.

- We can create more "targeted savings" buckets. We discuss targeted savings in this article; briefly, we plan for our future needs, and for each such need we create a separate investment track. This allows us to fund for events such as buying a home, our children's college fund, our annual vacations, etc. Once again, starting earlier provides a better guarantee that the targeted savings will actually reach their targets!

- We can experiment with different "risk versus return" investment scenarios, using small portions of our money for short periods (say, a few years) and learn which investments and strategies work best for us. If things go south, we still have time to recover. It is important to treat these as "experiments" and invest only small amounts of money; since the purpose is to learn and become better, we want to ensure that losses, if any, from these experiments shouldn't overwhelm or dishearten us. The article Understanding Investment Types lists the risk and return characteristics of different types of investments. Once we understand the "risk versus return" characteristics of different investment types and also our own risk tolerance, we can use that knowledge to form long-term investment strategies that maximize our returns.

Example

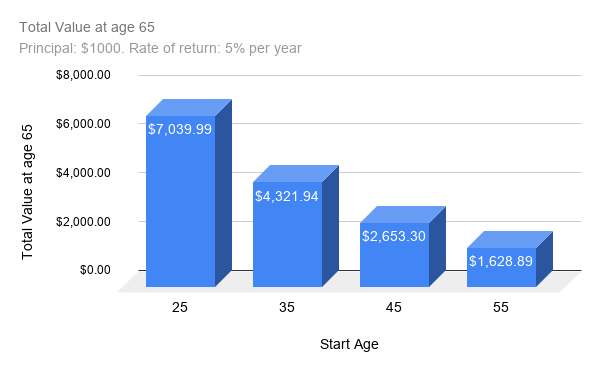

Let's see an example that illustrates the benefits of starting to invest at a younger age.

Let's say that we invest $1000 at 5% compound interest. Let's also say that we want to let the investment grow until we are 65, at which time we want to see both how much gain the investment has brought in and what the total value of the investment is. The table below shows the effect of starting our investment at different ages (25, 35, 45, 55):

Principal: $1000.

Rate of return: 5% per year.

| Start Age | Investment Period (Years) | Total Interest earned during the entire investment period | Total Investment Value = Principal + Total Interest, at age 65 |

|---|---|---|---|

| 25 | 40 (65 − 25) | $6039.99 | $7039.99 |

| 35 | 30 (65 − 35) | $3321.94 | $4321.94 |

| 45 | 20 (65 − 45) | $1653.30 | $2653.30 |

| 55 | 10 (65 − 55) | $628.89 | $1628.89 |

Here's the same information shown as a chart. We can see what a difference a few decades make!

Investing When Older

Let's look at ourselves when we're a bit older. We once again have some advantages and some disadvantages.

Aspects of an Older Investor

- Pro: we probably have been investing for a while. That means that compounding has really kicked in, and our profit every year is much bigger than it was when we were younger. That means, if we want to start a new investment, we could have a bigger principal amount to invest.

- Pro: our knowledge of investments is also much more than when we were younger and less experienced.

- Pro: we have paid off a lot of our debts; we may not have huge expenses (such as children's education) looming ahead. Most of the savings are now immediately available (to invest in new investments, or even for our daily expenses).

- Con: if we invest now and if any of our investments results in a loss, we have slightly less time to recover from the loss than when we were younger.

Strategies

Given the above aspects, what are the things to think about investing when older?

- If we're staring to put money in a new investment, we need to keep in mind that it might have a shorter time period to grow than for a younger investor. But, being older, we probably have a higher amount to invest. This could compensate for the shorter time period and could even make the investment to grow to the same level as it would for a younger investor. An example below illustrates this.

- Though our risk tolerance is somewhat lower, we can still invest in high return investments. With our experience in investing and understanding of how the various investments work, we know that we need to be aware of potential losses and proceed cautiously; perhaps keep the majority of our money in safe, low-risk investments and restrict the amount of money we invest in high return investments. The article Understanding Investment Types lists the risk and return characteristics of different types of investments.

Example

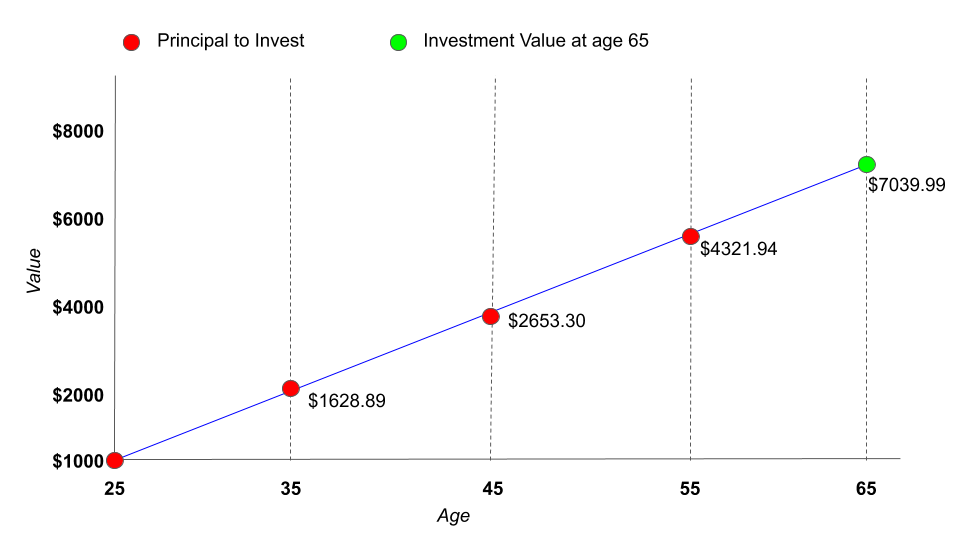

As an example, let's see what principal amount would allow us to achieve in a shorter time the same value that a 25 year old would achieve in 40 years (that is, if someone invested at the age of 25 and withdrew the entire amount at the age of 65). Let's say that the annual (compounding) interest rate is set at 5%.

| Start Age | Investment Period (Years) | Principal | Total Investment Value (Principal + Interest) at age 65 |

|---|---|---|---|

| 25 | 40 (65 − 25) | $1000.00 | $7039.99 |

| 35 | 30 (65 − 35) | $1628.89 | $7039.99 |

| 45 | 20 (65 − 45) | $2653.30 | $7039.99 |

| 55 | 10 (65 − 55) | $4321.94 | $7039.99 |

We see how having a larger principal (as a result of being older) can compensate for having shorter investment time frames.

The graph below shows the same information:

Summary

We learnt about aspects of age that could affect investing.

- Amount of capital available for investing: this increases with age, and can somewhat compensate for having a shorter time period.

- Time period to invest: we have more when we're younger. In other words, if we start when younger, we can achieve the same result that a larger capital will achieve, if we're willing to be patient.

- Risk tolerance: when younger, we have a higher tolerance for risk and can bounce back better from losses.

Once again, these aspects may affect each of us differently. As always, it is crucial to consult with a good financial advisor and tax consultant to understand and plan for each of our unique lifestyles and life events.